fundamental risk affects closed end funds in which of the following ways

Shares of closed-end funds frequently trade at a market price that is a discount to their NAV. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments.

Closed End Fund Cef Vs Exchange Traded Fund Etf Study Com

A managed fund will outperform an index fund only 60 of the time.

. We exclude all fund-date combinations in which the total net assets reported by Thomson Reuters differs from the CRSP database by more than 100. Mutual funds typically offer more diversification and less risk than purchasing one or two individual securities. Examples of closed-end funds include.

An example is when borrowers default on a principal Principal Payment A principal payment is a payment toward the original amount of a loan that is owed. As in the case of closed end funds. This would be true in particular when fundamental risk is a substantial part of volatility.

The higher the expected return the higher the risk. An investor can find price quotations for closed-end and open-end funds. For open-end funds if a company offers several different funds.

Funds can close for various reasons. Managed funds may be open-end funds or closed-end funds. Find out why mutual funds like all investments are subject to market risk including how the different types of market risk apply to different types of funds.

Closed-end funds also known as closed-ended funds or CEFs and open-ended funds appear to be the same type of investment in many ways. We excludes ADRs ATCs REITs and closed-end funds and focus on the common shares of domestic securities with a share code of 10 or 11. Fundamental research is critical for a full understanding of the risks and opportunities that ESG factors.

Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency. It occurs when borrowers or counterparties fail to meet contractual obligations. Financial risk management is a function within organizations that aims to detect manage and hedge exposure to various risks stemming from the use of financial services.

Funds primarily close because the investment advisor. The COVID-19 world health crisis has profound implications for the care and education of young children in homes and schools the lives of preservice and inservice teachers and the work of collegeuniversity faculty. This article begins by discussing.

A widespread health crisis such as a global pandemic could cause substantial market volatility exchange-trading suspensions and closures affect the ability to complete redemptions and affect fund performance. A benchmark of a good fund manager is the ability to increase share value when the economy is good and retain that value when the economy is bad. Closed-end funds are subject to management fees and other expenses.

In financial papers and at financial websites. A funds objective is stated in its prospectus. Similar to previous studies we employ the following filters.

Financial Risk Management at the Institutional Level. Their yields range from 632 on average for bond CEFs to. Ekaterina Svetlova Karl-Heinz Thielmann in International Encyclopedia of Human Geography Second Edition 2020.

For example the novel coronavirus disease COVID-19 has resulted in significant disruptions to global business activity. In addition where possible holdings information is obtained directly from mutual funds on a more frequent basis. Mutual fund information is derived from forms NQ quarterly and NCSRs annually.

Managed funds may be open-end funds or closed-end funds. Which of the following combines some of the operating characteristics of an open end fund with some of the trading characteristics of a closed end fund. This can result in.

A closed fund is a fund that is closed - either temporarily or permanently - to investors. Insider Ownership data which reflects changes in ownership by directors officers and principal stakeholders comes from filings of Forms 3 and 4. Closed-end funds operate more like ETFs in that they trade throughout the day on a stock exchange.

They are built on the idea of diversification pool investment dollars from a large group of individual investors and are generally managed by a team of Wall Street pros. ESG analysis is integrated into each of the stages of the investment process. Closed-end funds have the ability to use leverage which can lead to greater risk.

The complexity here is far higher. A benchmark of a good fund manager is the ability to increase share value when the economy is good and retain that value when the economy is bad. _____ risk affects all stock mutual funds.

Credit risk is the biggest risk for banks. All bonds are subjected to _____ risk. Closed-end funds have stood the test of time for more than a century and have the potential to help savvy investors.

Interestingly Warther 1995 also shows that fund flows in and out of mutual funds affect contemporaneous returns of securities these funds hold consistent with the results established below. In other words a principal payment is a payment made on a loan that reduces the remaining loan. Closed-end funds CEFs can be one solution with yields averaging 673.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. A managed fund will outperform an index fund only 60 of the time. The fund manager does not separate ESG issues from the rigorous analysis conducted for each and every investment which seeks to generate risk-adjusted return.

What Is The Difference Between Closed And Open Ended Funds Quora

What Is The Difference Between Closed And Open Ended Funds Quora

What Is The Difference Between Closed And Open Ended Funds Quora

Chapter 1 Understanding Investments Learning Objectives Define Investment And Discuss What It Means To Study Investments Explain Why Risk And Return Ppt Download

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

Mutual Funds And Market Dislocations Systemic Risk And Systematic Value

Understanding Closed End Vs Open End Funds What S The Difference

What Is The Difference Between Closed And Open Ended Funds Quora

Open Ended And Evergreen Funds In Venture Capital Toptal

Wondering About Closed End Funds Learn A Few Basics Ticker Tape

Federal Register Securities Offering Reform For Closed End Investment Companies

What Is The Difference Between Closed And Open Ended Funds Quora

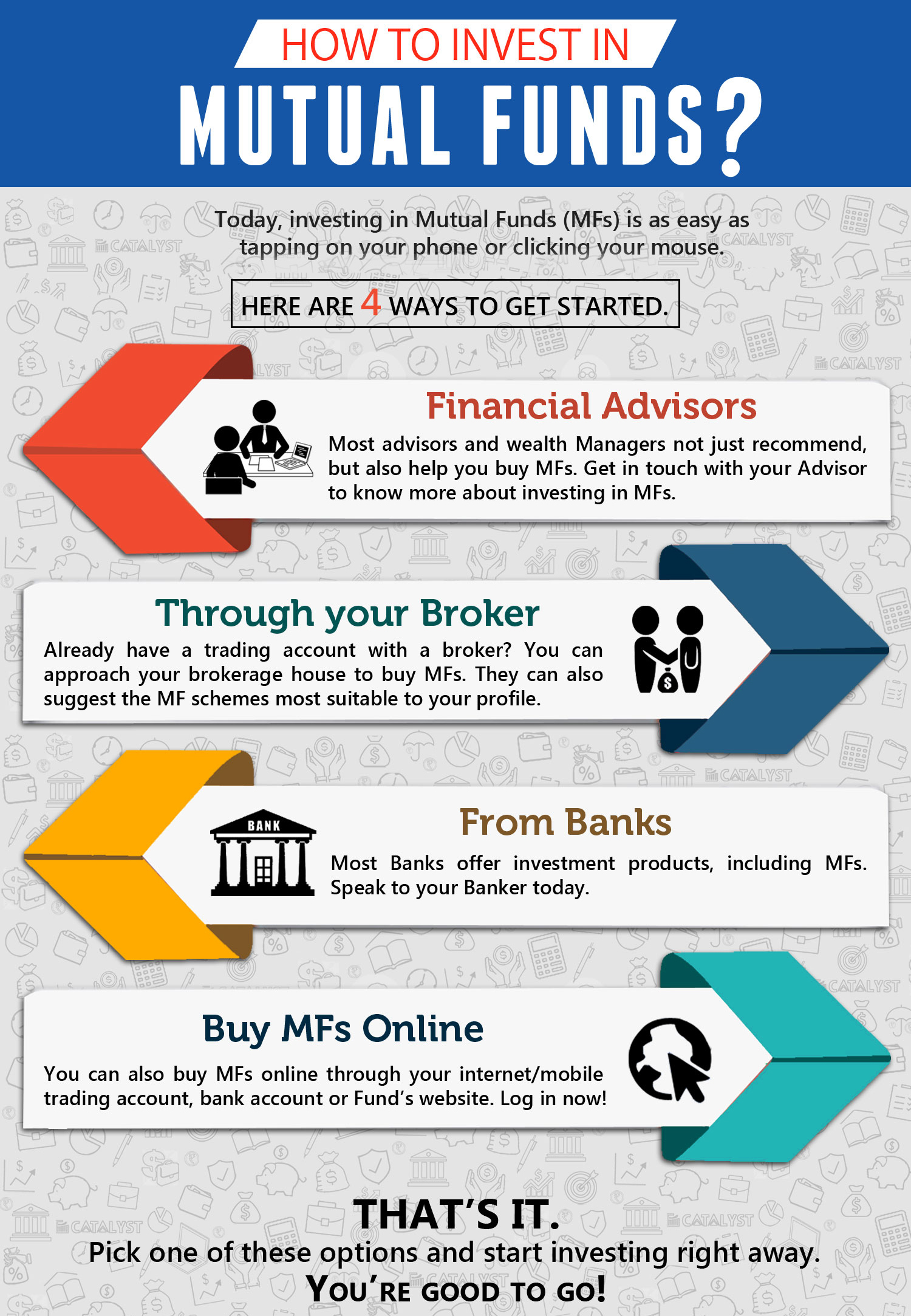

How To Invest In Mutual Funds Jamapunji

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)